Dallas' Lincoln Centre hotel, with $75 million in debt, goes back under lender control

Date: Aug 27, 2018 07:47 PM

https://www.dallasnews.com/business/real-estate/2018/08/24/dallas-lincoln-centre-hotel-75-million-debt-goes-back-lender-control

Story by Dallas News, Karen Robinson - Jacobs, Hospitality / Leisure Industry Reporter.

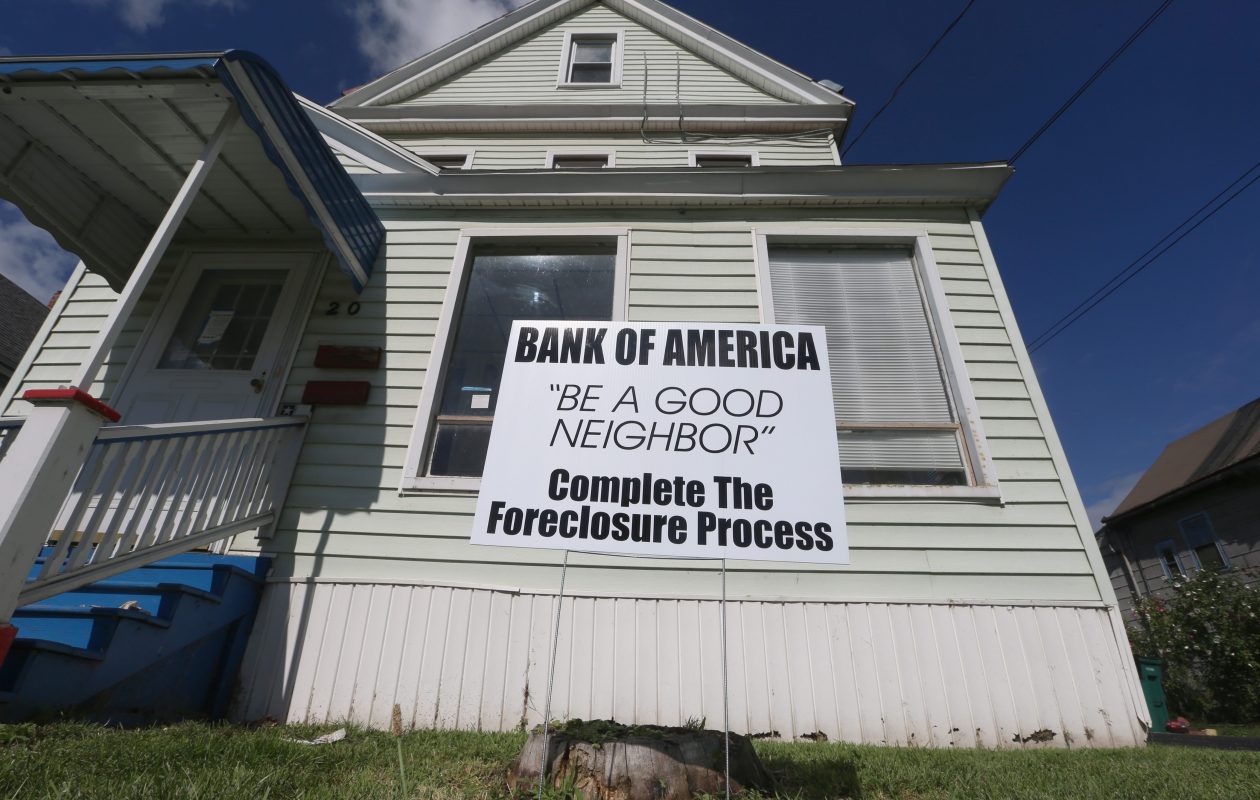

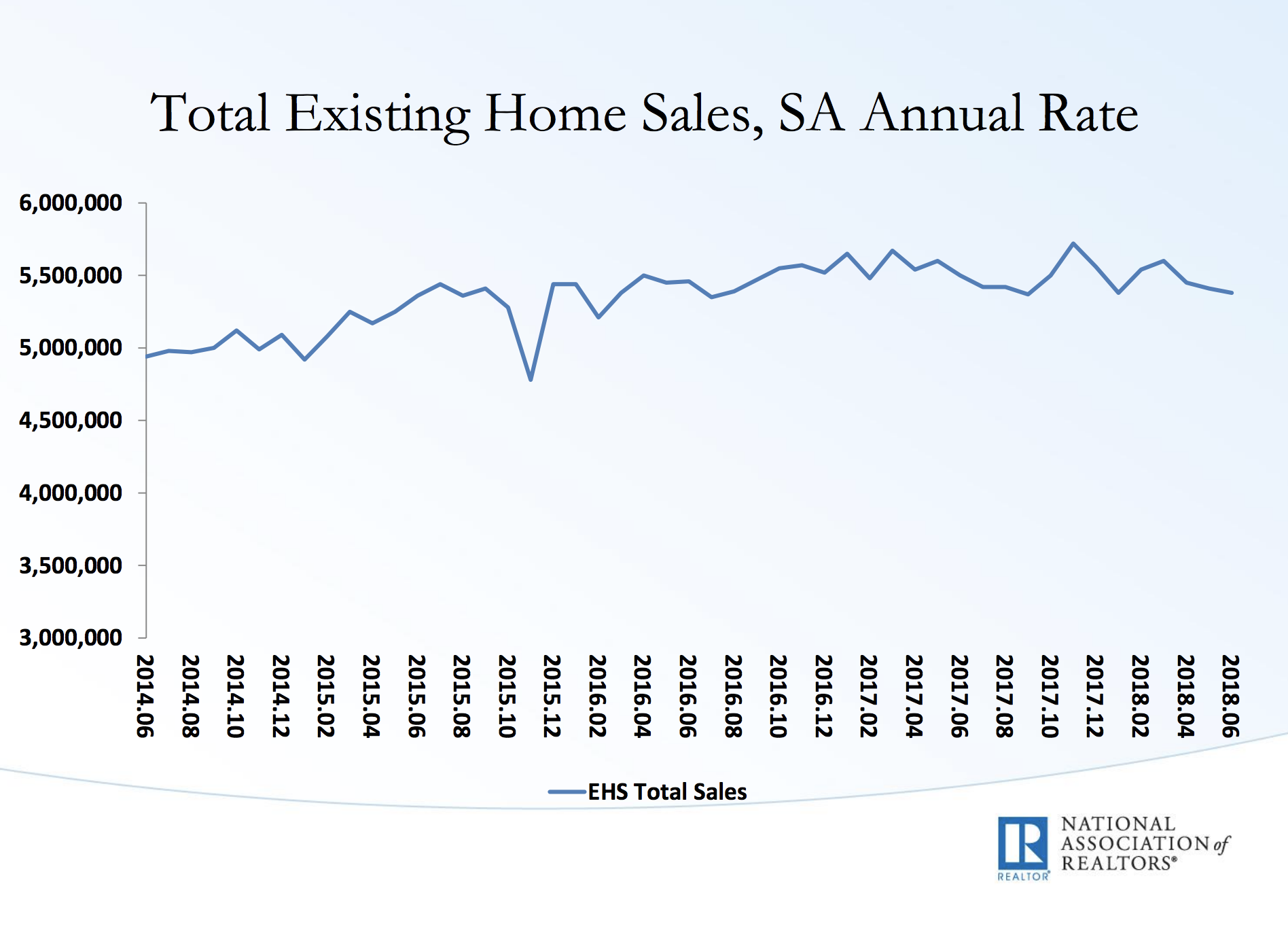

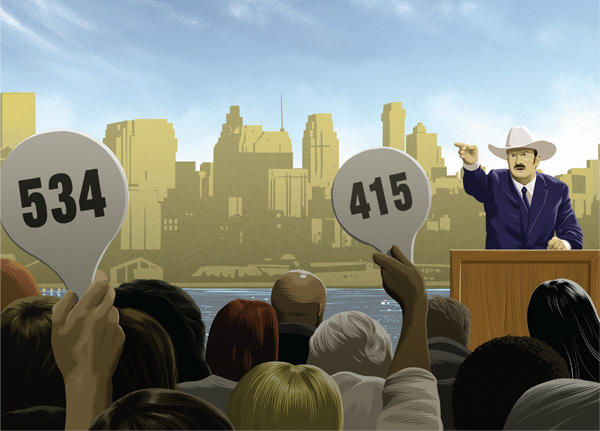

One of North Texas' largest hotels is now in the hands of its lender, following a foreclosure sale earlier this month. The 500-room Hilton Dallas Lincoln Centre, at LBJ Freeway and the Dallas North Tollway, reverted to Colony Capital, a publicly traded REIT founded in 1991 by Thomas Barrack Jr., a close ally of President Donald Trump. The company declined to comment. ADVERTISING inRead invented by Teads No bidders attended the sale, said Curtis Roddy, vice president of operations for Addison-based Roddy's Foreclosure Listing Service. The 20-story hotel, part of the landmark Lincoln Centre complex built in the early 1980s, was owned by Apollo Real Estate Advisors. Ares Management acquired all of Apollo Real Estate Advisors about 5 years ago. Officials with Ares Management could not be reached for comment late Friday. Apollo paid over $72 million for the Lincoln Centre Hilton in 2008 and later made substantial upgrades to the property. A 2014 loan on the property, for $75 million, went into default, according to a document in the Dallas County clerk's office. Hilton continues to operate the hotel, which saw its revenue dip by nearly 3 percent in the 12 months that ended June 30 to $16.28 million, according to hotel consultants Source Strategies.

(Source Strategies) (Source Strategies) It was not immediately clear what Colony has planned for the hotel, which sits on a 3-acre parcel. ADVERTISING inRead invented by Teads "It's definitely a niche market, [finding] somebody that's ready to spend $75 million on that property," Roddy said. "I think it's going to be a difficult process. It's an older hotel." The hotel is less than 2 miles from the site of the former Valley View Center, which is largely torn down but is slated to be redeveloped. "It's in a great location," Roddy said, adding that if the hotel is bringing in enough cash "and there's no major problems, it's probably going to be a great deal" for the right buyer.