Brutal Week For Real Estate As Rates Surge

Date: Oct 08, 2018 10:07 AM

Brutal Week For Real Estate As Rates Surge

Summary

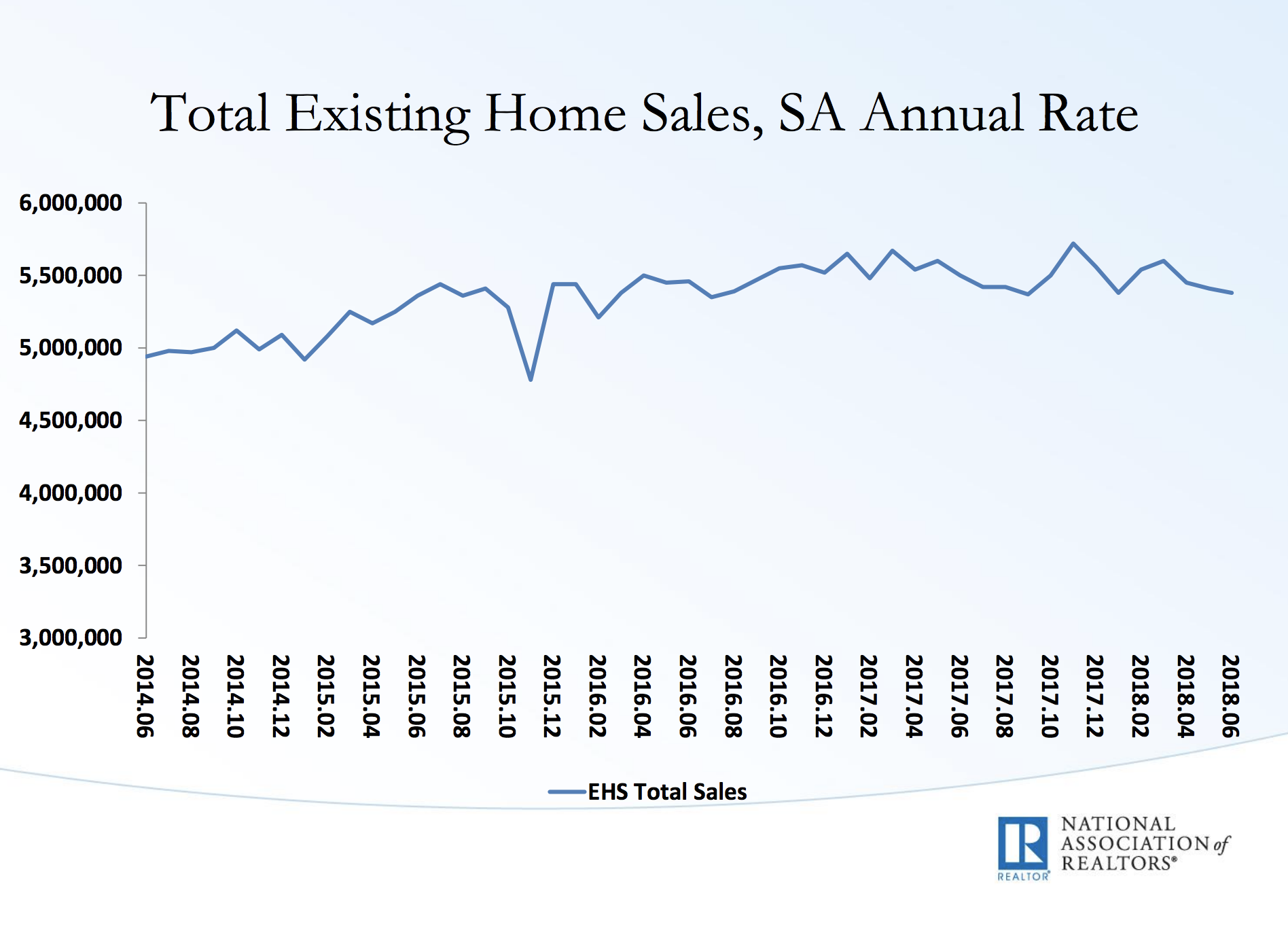

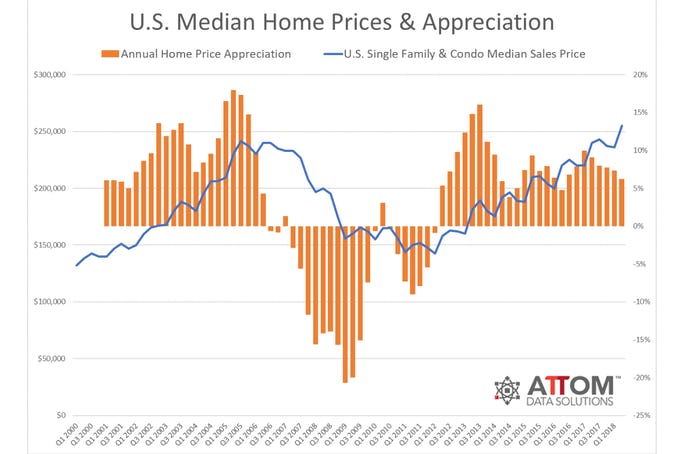

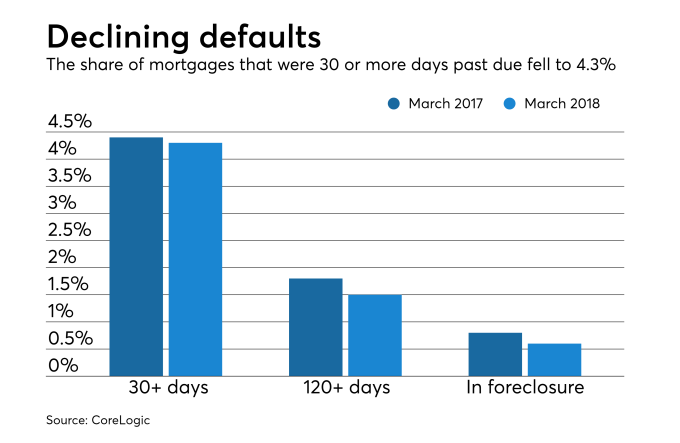

Homebuilders and REITs dipped for the second consecutive week, pressured by the sudden surge in the 10-Year yield. Homebuilders have lost nearly a quarter of their market value this year.

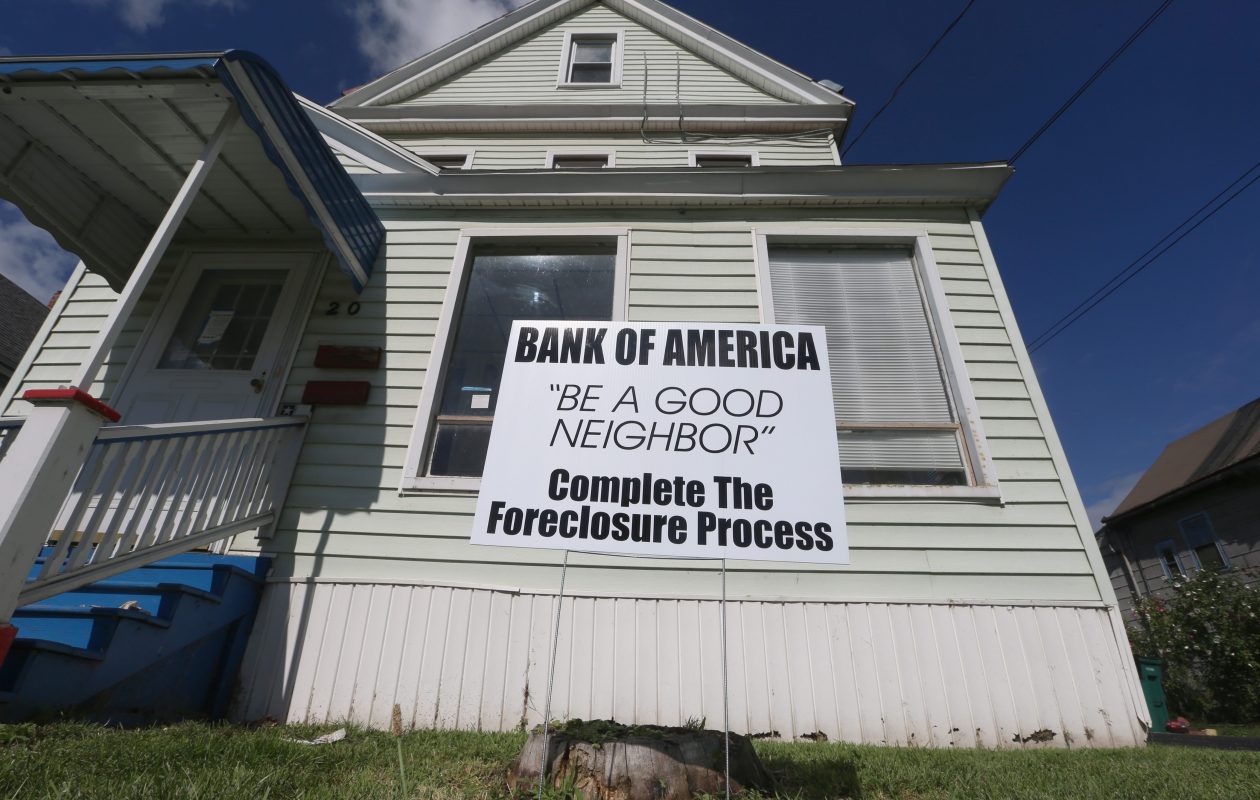

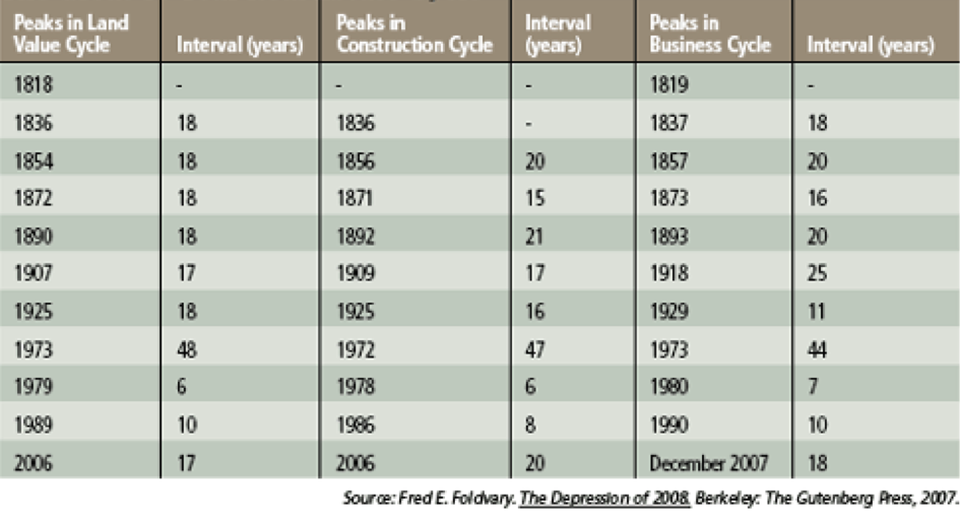

While housing data has indeed softened over the summer, the underlying backdrop of pent-up housing demand and an overall housing shortage remain positive for long-term housing fundamentals.

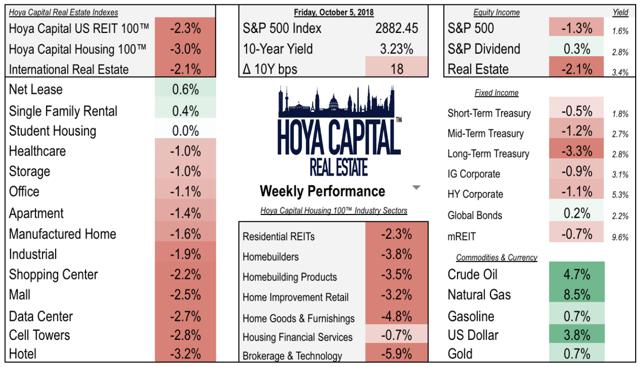

The S&P 500 dipped 1% despite solid economic data and positive news on trade relations with Canada and Mexico. Domestic politics continues to be a focus with mid-term elections approaching.

Job growth continues to impress as the unemployment rate dipped to 49-year lows. Wage growth is hovering around the strongest level in a decade. The pace of hiring has accelerated in 2018, powered by tax reform and deregulation.

Goods-producing sectors, particularly manufacturing and construction, have powered the 2018 reacceleration. Despite the economic backdrop, however, construction spending has trended sideways in recent quarters.

Real Estate Weekly Review

The sudden surge in the 10-Year yield to levels last seen in 2011 pressured interest rate-senstive sectors this week, along with the broader US equity market. The S&P 500 (SPY) retreated more than 1% this week despite strong economic data and positive news on trade relations with the US, Canada, and Mexico reaching an agreement on NAFTA. Real estate sectors were among the weakest, with REITs (VNQ and IYR) dipping more than 2% and homebuilders (XHB and ITB) dropping another 4%.

Source: https://seekingalpha.com/article/4210200-brutal-week-real-estate-rates-surge